Exposing 5 Common Myths About Payday Loans and the Truth Behind Them

Payday loans are short-term, high-cost loans typically designed to cover urgent, small-scale financial needs until your next paycheck. These loans are often advertised as a quick and easy solution for people facing temporary cash shortfalls. However, payday loans are often misunderstood, and there are many myths that circulate about them. Some of these myths contribute to negative perceptions about payday loans, making people hesitant to use them when they may be a viable option. This article aims to clarify the truth behind five common myths surrounding payday loans, offering a clearer understanding of how they work and who they are best suited for. Myths About Payday Loans

What are payday loans, and how do they work?

A payday loan is a small, short-term loan that is typically due on your next payday. These loans are often used by individuals who need immediate cash but may not have access to traditional credit options. The loan amount is usually based on your income, and in many cases, it is repaid in a lump sum, with the lender expecting payment on your next payday.

Why are payday loans often misunderstood?

Payday loans have been a subject of controversy for many years, partly because of the high-interest rates they often carry. They are often seen as a last-resort option for individuals who can’t qualify for more traditional forms of credit. However, many of the negative perceptions about payday loans stem from myths, misconceptions, and lack of understanding.

In this article, we’ll explore five of the most common myths about payday loans and explain the truth behind them.

Myth #1: Payday Loans Are Only for People with Bad Credit

One of the most pervasive myths about payday loans is that they are only accessible to people with poor credit scores. This is often the perception because payday loans are marketed to individuals who may have difficulty obtaining credit from banks or other traditional lenders. However, the reality is more nuanced.

How payday loans are marketed and perceived

Payday lenders often advertise their services to individuals who need quick cash, without requiring a credit check or a long application process. This can make payday loans seem like an option primarily for those with bad credit, even though that’s not always the case. The appeal of payday loans lies in their accessibility, especially for people who may not have the credit history or the collateral needed for other types of loans.

Who can qualify for payday loans?

In reality, payday loans can be available to individuals with a wide range of credit scores. Most payday lenders do not perform credit checks, which means that they are not as concerned with your credit history. Instead, lenders typically look at your income to determine whether you can repay the loan. As long as you can prove that you have a steady income, you may be eligible for a payday loan, even if you have a good credit score.

Alternatives for people with poor credit

While payday loans may seem like an easy solution for individuals with poor credit, they aren’t always the best choice. People with bad credit may also consider alternatives such as:

- Personal loans from credit unions or online lenders: These may have lower interest rates and more flexible repayment terms compared to payday loans.

- Credit cards with lower interest rates: If you have access to a credit card, using it for a short-term loan might be cheaper than a payday loan, depending on the terms.

- Borrowing from friends or family: This can be a less expensive option, especially if the loan is interest-free.

Myth #2: Payday Loans Trap Borrowers in a Cycle of Debt

Another common myth about payday loans is that they inevitably trap borrowers in a cycle of debt. The perception is that people borrow money to pay for immediate needs, but when they can’t repay the loan on time, they borrow again, leading to a never-ending cycle.

Do payday loans create an endless cycle of debt?

While it is true that payday loans can become expensive if not managed properly, they don’t necessarily lead to a cycle of debt. Like any financial product, payday loans can be used responsibly. Many people use payday loans as a short-term solution to address urgent financial needs and repay them in full on the due date.

Examples and statistics showing responsible use

In a study by the Consumer Financial Protection Bureau (CFPB), it was found that most payday loan borrowers (about 70%) took out a payday loan for one-time emergencies, such as car repairs or medical expenses. While some individuals do take out multiple payday loans, the majority of borrowers use them sparingly.

Tips for managing payday loans responsibly

To avoid falling into a debt trap, here are a few tips for managing payday loans:

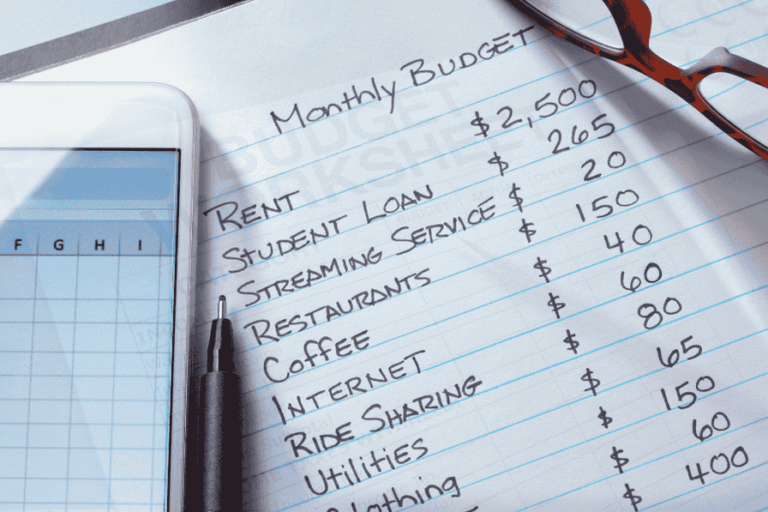

- Borrow only what you can afford to repay: Make sure you can comfortably pay back the loan on your next payday, taking into account your regular expenses.

- Set a budget: Plan ahead and ensure that your regular budget allows for the payday loan repayment without jeopardizing your other financial obligations.

- Seek assistance if you’re struggling: If you’re having difficulty repaying the loan, reach out to the lender to discuss possible extensions or alternative repayment plans.

Myth #3: Payday Loans Are Always High-Interest and Exploitative

One of the biggest myths about payday loans is that they are always accompanied by exorbitant interest rates that make them exploitative. While it’s true that payday loans generally come with higher interest rates than traditional loans, the actual rates can vary significantly across different lenders and jurisdictions.

Differences in interest rates and fees

Payday loan interest rates can range from 200% to 400% APR (Annual Percentage Rate), depending on the lender and the state in which the loan is made. However, these high rates reflect the short-term nature of the loans and the risk that lenders take on by offering loans without credit checks.

Some states have enacted regulations to cap payday loan interest rates, making them more affordable for consumers. For example, some states impose a maximum APR limit, ranging from 36% to 100%, which helps to prevent lenders from charging excessive fees.

Regulations to protect consumers

In recent years, several states have introduced legislation to protect consumers from predatory payday lending practices. These regulations often include limits on loan amounts, repayment terms, and interest rates. For instance, the Military Lending Act (MLA) places a 36% interest rate cap on payday loans for active-duty military personnel and their families.

How payday loans compare to other credit options

While payday loans may have higher interest rates than traditional loans, they are often less expensive than credit card cash advances or late fees for overdue bills. For some individuals, payday loans may offer a more affordable option compared to missing payments or incurring penalties.

Myth #4: Payday Loans Are Only for Emergencies

Many people believe that payday loans are only suitable for emergency situations. While payday loans are often used to cover urgent expenses, they can also be used for planned expenses that need to be covered before a paycheck arrives.

Use cases for payday loans

Payday loans are versatile and can be used for a variety of purposes, including:

- Unexpected medical expenses: If you have a medical emergency and need to pay upfront for treatment or prescription costs, a payday loan can provide quick relief.

- Car repairs or emergencies: If your car breaks down and you need it repaired to get to work, payday loans can help you cover the cost before your next paycheck.

- Utility bills: If you’re facing a disconnection notice for your utilities, a payday loan can prevent that from happening by covering the outstanding balance.

Myth #5: Payday Loans Are Difficult to Qualify For

Some individuals assume that payday loans are difficult to qualify for, requiring extensive documentation and credit checks. In reality, payday loans are typically easy to qualify for, with fewer requirements than traditional loans.

What do payday lenders require?

In most cases, payday lenders will ask for basic documentation such as:

- Proof of income (pay stubs, bank statements, or a job verification letter)

- A valid ID

- A bank account to deposit the loan amount

As long as you meet these basic requirements, the application process is generally straightforward and quick, with some lenders offering online applications that can be completed within minutes.

Conclusion

Payday loans are often misunderstood, and many of the myths surrounding them can create unnecessary fear or confusion. By understanding the facts behind these loans—such as who qualifies for them, how they work, and how they can be used responsibly—borrowers can make more informed decisions about whether payday loans are a good fit for their financial needs.