7 Ways to Avoid Lifestyle Inflation While Earning More Money

Earning more money can feel like a major victory, but if you’re not careful, the increase in your income can lead to a lifestyle inflation trap. This happens when your spending increases proportionally with your income, leaving you no better off than before. In fact, many people end up in the same financial position, or worse, despite earning more. To avoid falling into this cycle, it’s crucial to manage your finances wisely and focus on long-term financial goals. Below, we’ll explore how to avoid lifestyle inflation and keep your financial growth on track.

1. Understanding Lifestyle Inflation: What It Is and Why You Should Avoid It

What is Lifestyle Inflation?

Lifestyle inflation, or “lifestyle creep,” is the tendency for people to increase their spending as their income rises. While it’s natural to want to enjoy the fruits of your labor, lifestyle inflation can quickly erode any financial progress you’re making. For example, a person who receives a raise might decide to upgrade their car, rent a more expensive apartment, or start dining out more frequently, all of which can lead to higher fixed costs and less money available for savings or investments.

Real-World Example

Consider the case of Sarah, a marketing professional who recently received a significant salary increase. At first, she was diligent about saving and investing, but as her paycheck grew, so did her spending habits. She upgraded her car, started booking more vacations, and moved into a more expensive apartment. Within a few months, Sarah found that despite making more money, she wasn’t any further ahead financially. In fact, her savings were lower than before because her new lifestyle had absorbed her increased income.

Why You Should Avoid Lifestyle Inflation

Avoiding lifestyle inflation is crucial for long-term financial health. If you spend more just because you earn more, you’re never able to build wealth. Instead of improving your financial situation, lifestyle inflation keeps you in a constant cycle of living paycheck to paycheck, regardless of how much you earn. This can prevent you from achieving important financial goals, such as buying a home, retiring comfortably, or becoming financially independent.

2. Practical Tips for Saving Money While Earning More

As your income grows, it’s essential to adjust your money management strategies to ensure that you don’t fall into the trap of lifestyle inflation. Here’s a step-by-step guide to help you stay on track:

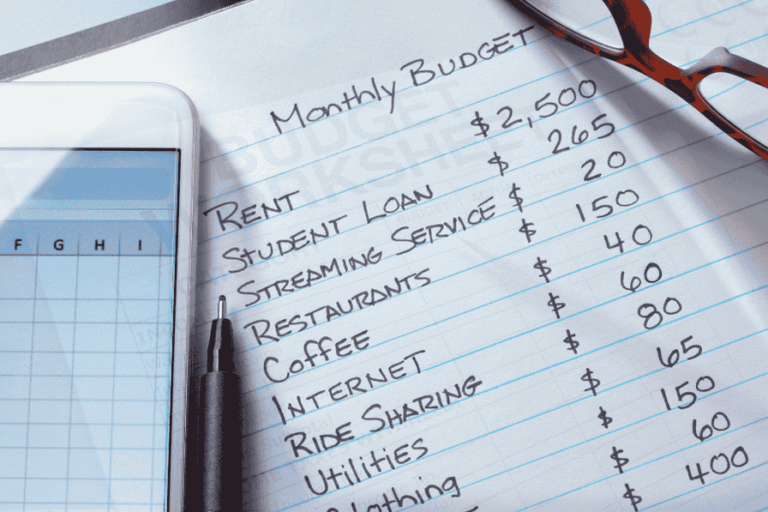

Step 1: Create a Budget and Stick to It

A solid budget is the foundation of any good financial plan. Even as your income increases, having a clear budget helps ensure that you’re not spending more than you should. A good rule of thumb is to allocate your money into categories like housing, transportation, groceries, savings, and discretionary spending. Make sure your savings rate remains high even as your income rises.

Example: Suppose you earn an additional $1,000 per month. Instead of letting the extra money get absorbed into your spending, allocate at least 50% of that toward savings and investments. You might want to increase your contributions to retirement accounts or set up a brokerage account for wealth-building investments.

Step 2: Automate Your Savings and Investments

Once your budget is in place, automate your savings and investment contributions. This takes the temptation out of the equation and ensures you’re prioritizing your financial future. Set up automatic transfers to your savings account or retirement fund each time you get paid.

Step 3: Live Below Your Means

Even as you earn more, continue to live below your means. You don’t have to upgrade your lifestyle just because your paycheck increased. For example, if you receive a raise, avoid immediately spending it on luxury goods or expensive experiences. Instead, consider keeping your expenses the same and using the extra income for investments or to pay down debt.

Step 4: Track Your Spending

Tracking your spending is essential for keeping an eye on where your money is going. Use an app or budgeting tool to monitor your monthly expenditures. If you notice you’re starting to spend more than you intended, make adjustments to stay within your budget.

3. How to Stay Financially Disciplined Even with a Bigger Paycheck

The psychology of spending can be tricky. As you start to earn more, it’s easy to feel justified in spending more. However, this mindset can quickly spiral out of control. Here are some tips for maintaining financial discipline, even when your paycheck grows:

Recognize the Triggers of Over-Spending

Many people spend more when they experience certain triggers, such as stress, peer pressure, or boredom. Recognize these triggers in yourself and come up with strategies to deal with them. For example, instead of shopping when you’re feeling stressed, try going for a walk or practicing mindfulness to help curb impulsive spending.

Keep Long-Term Goals in Mind

It’s much easier to stay disciplined if you have a clear picture of what you’re working toward. Whether your goal is to buy a home, pay off debt, or retire early, keeping those goals at the forefront of your mind can help you resist the temptation to overspend.

Create a “Fun Fund”

One way to balance financial discipline with enjoying life is by setting up a “fun fund.” This is a separate account where you allocate a portion of your income for entertainment and non-essential purchases. By having a set amount for fun spending, you can enjoy the perks of earning more without derailing your savings goals.

4. The Relationship Between Financial Goals and Lifestyle Choices

Financial goals and lifestyle choices go hand-in-hand. To avoid lifestyle inflation, it’s important to make intentional decisions that align with your financial goals. Here are some ways to ensure your lifestyle choices help, rather than hinder, your financial growth:

Prioritize Needs Over Wants

When you earn more money, you might feel the urge to satisfy more wants, but remember that true financial stability comes from prioritizing needs. This means focusing on things like a stable housing situation, transportation, and health insurance, rather than indulging in the latest gadgets or trendy clothing.

Invest in Experiences, Not Things

One way to avoid lifestyle inflation is by focusing on experiences that add value to your life without increasing your expenses. Instead of buying a more expensive car or designer clothes, consider investing in meaningful experiences, such as traveling, taking a class, or spending time with loved ones.

Set Realistic Milestones for Lifestyle Upgrades

If you do want to upgrade aspects of your lifestyle, set clear milestones. For example, plan to upgrade your home only after you’ve fully funded your emergency savings and retirement accounts. Avoid making these upgrades just because your income has increased, as that can lead to unnecessary spending.

5. How to Use the ’80/20 Rule’ to Prevent Lifestyle Inflation

The 80/20 rule, also known as the Pareto Principle, states that 80% of your results come from 20% of your efforts. You can apply this principle to your finances to help prevent lifestyle inflation:

Apply the 80/20 Rule to Your Spending

When you earn more money, focus on the 20% of your expenses that contribute to the majority of your satisfaction. For example, if traveling brings you the most joy, allocate more of your income toward travel rather than buying new clothes or gadgets. By focusing on the things that matter most, you’ll avoid overspending on things that won’t bring lasting happiness.

Save 80%, Spend 20%

Another way to apply the 80/20 rule is by saving 80% of your income and only spending 20%. While this may seem challenging, it’s a great way to supercharge your savings and build wealth quickly. As your income rises, aim to keep your expenses as low as possible so that most of your earnings go toward savings and investments.

6. How to Build Wealth Without Compromising Your Lifestyle

Building wealth without sacrificing your lifestyle is achievable with careful planning and discipline. Here are some strategies to help you do just that:

Maximize Retirement Contributions

One of the best ways to build wealth without changing your lifestyle is by contributing to retirement accounts like a 401(k) or IRA. These accounts offer tax benefits and can significantly grow over time, providing you with financial security in the future.

Diversify Your Investments

In addition to contributing to retirement accounts, consider diversifying your investments in stocks, bonds, or real estate. This can help you build wealth without increasing your lifestyle expenses. Focus on long-term growth strategies that won’t require a drastic change in your day-to-day living.

Maintain a Healthy Work-Life Balance

Finally, ensure that you’re not overworking yourself to keep up with a higher lifestyle. A healthy work-life balance is key to long-term financial success and personal well-being. Work hard, but also make time for self-care, family, and leisure activities that help you recharge.

By following these strategies, you can avoid lifestyle inflation while earning more money, ensuring that your financial growth is sustainable and aligned with your long-term goals. Instead of letting increased income lead to higher spending, focus on saving, investing, and living below your means to build lasting wealth and financial security.