5 Free Online Budgeting Tools to Create a Personal Budget Step-by-Step

Free online budgeting tools are revolutionizing the way we manage our finances, making it easier than ever to create a personal budget that works. These tools offer user-friendly features to help you track expenses, set goals, and stay on top of your financial plan without spending a dime. Whether you’re saving for a major purchase or trying to reduce debt, using free online tools can simplify budgeting and give you the control you need to reach your goals.

Step-by-Step Guide to Building a Budget

Creating a personal budget doesn’t have to be overwhelming. Here’s a step-by-step guide to help you build an effective budget using free tools:

- Calculate Your Income

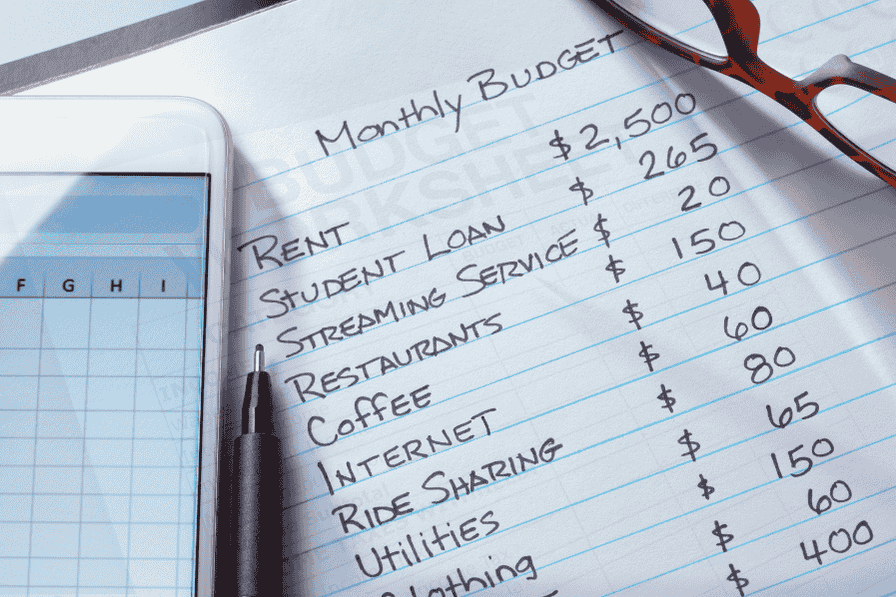

Determine your total monthly income, including salary, side gigs, and other sources of money. Be sure to account for net income after taxes. - Track Your Expenses

Use an online tool to monitor where your money goes. Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment) costs. - Set Financial Goals

Decide on short-term and long-term goals, such as saving for a vacation, paying off debt, or building an emergency fund. - Choose a Budgeting Method

Whether you prefer the 50/30/20 rule (needs/wants/savings) or zero-based budgeting, online tools can help you implement these methods effectively. - Adjust Your Budget Regularly

Review your budget monthly to account for any changes in income or expenses. Many tools allow you to make quick adjustments based on your evolving needs. - Automate and Track Progress

Leverage free tools to automate savings, bill payments, or reminders. Use reports and charts to assess your progress.

The Best Free Online Tools for Budgeting

Here are five free tools that make budgeting easier for various needs:

- Mint

Mint is a comprehensive budgeting app that connects to your bank accounts and categorizes expenses automatically.

Pros: User-friendly interface, bill reminders, and real-time updates.

Cons: Ads within the app might feel intrusive.

Best For: Beginners and individuals who want an all-in-one solution. - YNAB (You Need a Budget)

While the full version has a cost, YNAB offers a free trial that’s worth exploring. It emphasizes proactive budgeting and aligning your money with your priorities.

Pros: Highly detailed tracking and goal-oriented features.

Cons: Slight learning curve.

Best For: Individuals looking for in-depth financial planning. - Google Sheets

This flexible spreadsheet tool can be customized for budgeting with templates or formulas.

Pros: Fully customizable, no cost, and ideal for detailed planners.

Cons: Requires manual input unless paired with automation tools.

Best For: Advanced users who enjoy hands-on control. - Goodbudget

This app uses the envelope budgeting system, allowing you to allocate money to virtual “envelopes” for each expense category.

Pros: Simple and effective for tracking specific categories.

Cons: Limited free features compared to other apps.

Best For: Families managing household budgets. - Personal Capital

This tool is great for both budgeting and investment tracking, providing a holistic view of your finances.

Pros: Detailed financial summaries and net worth tracking.

Cons: Focuses more on wealth management than everyday budgeting.

Best For: Freelancers and those interested in long-term financial planning.

How to Use Mint to Create Your Budget

Mint is one of the most popular free budgeting tools, thanks to its ease of use and robust features. Here’s how you can set up a budget with Mint:

- Sign Up and Link Accounts

Create a free account and securely connect your bank accounts, credit cards, and other financial institutions. - Categorize Transactions

Mint automatically sorts your transactions into categories like groceries, utilities, and dining. You can edit these categories if needed. - Set Up Budgets

Go to the “Budgets” tab and create spending limits for each category. Mint will notify you if you’re nearing or exceeding these limits. - Track Goals

Use the “Goals” feature to save for specific items, like a car or a vacation. Mint tracks your progress and adjusts your budget accordingly. - Monitor Your Finances

Check Mint regularly to view detailed reports, charts, and spending trends. These insights can help you make smarter financial decisions.

Budgeting Tips for Different Life Stages

Different life stages bring unique financial challenges. Here’s how free tools can help:

- Students

Focus on tracking small expenses like coffee or snacks, which can add up. Tools like Goodbudget are great for managing limited funds. - New Graduates

Prioritize paying off student loans and building savings. Mint can help automate payments and track progress. - Young Families

Use apps like Google Sheets to plan for childcare costs, groceries, and family activities while staying flexible. - Retirees

Monitor fixed incomes and healthcare expenses with Personal Capital, which also offers investment insights.

Common Budgeting Mistakes to Avoid

Even with the best tools, budgeting pitfalls can happen. Here are some mistakes to watch for:

- Overcomplicating the Process

Choose a simple method and stick to it. Free tools like Mint simplify categorization and tracking. - Ignoring Irregular Expenses

Account for seasonal costs like holiday shopping or annual insurance payments. Use tools to set aside funds monthly. - Not Adjusting for Changes

Regularly update your budget as income or expenses fluctuate. Tools with real-time updates, like Mint, make this easier. - Failing to Save

Prioritize savings in your budget. Apps like YNAB encourage you to plan for future expenses before spending.

Case Study: Budgeting with Free Online Tools

Meet Sarah, a young professional struggling to manage her finances. Her goals included paying off credit card debt and saving for a down payment on a house. She started using Mint to link her accounts, categorize spending, and set a monthly budget. Initially, Sarah faced challenges staying within her dining-out budget but adjusted by setting weekly spending limits. Within a year, she paid off her debt and saved $10,000—all while staying motivated through Mint’s goal-tracking features.

How to Stay Consistent with Your Budget

Consistency is key to successful budgeting. Here are actionable strategies:

- Set Reminders

Use app notifications to review your budget weekly or monthly. - Automate Your Finances

Schedule bill payments and automate savings transfers through tools like Mint or your bank. - Review Reports Regularly

Analyze spending trends using online tools to identify areas for improvement. - Celebrate Milestones

Reward yourself for sticking to your budget and achieving goals, even if it’s something small.

Frequently Asked Questions about Online Budgeting Tools

- Are these tools safe to use?

Most reputable tools use bank-level encryption to protect your data. - Do they work for people with irregular incomes?

Yes, tools like YNAB are designed to accommodate varying income levels. - What if I don’t like using apps?

Google Sheets is a great non-app option that you can customize to suit your needs. - Can they handle multiple accounts?

Yes, tools like Mint and Personal Capital can link multiple accounts for a comprehensive view.

Interactive Resource

To help you start budgeting right away, here’s a Google Sheets Budget Template you can download and customize. This template includes sections for income, expenses, and savings goals, making it easier to track your finances and adjust as needed.

Building and maintaining a personal budget doesn’t have to be overwhelming or expensive. With the help of free online tools, you can create a plan that aligns with your financial goals and fits your lifestyle. From calculating your income and tracking expenses to setting goals and adjusting as needed, these tools make it easy to stay organized and in control.

By choosing the right budgeting method and tools, you can avoid common mistakes, tailor your budget to different life stages, and remain consistent over time. Whether you’re a student managing limited funds, a family juggling multiple priorities, or someone preparing for retirement, there’s a solution that suits your needs.

With dedication and the right approach, budgeting becomes more than just managing money—it’s about gaining peace of mind and building a secure future. Take the first step today by exploring the free resources available and setting up a budget that puts you on the path to financial success.