7 Key Steps to Secure Personal Loans for Non-U.S. Citizens: A Complete Guide

Secure Personal Loans for Non-U.S. Citizens: A Complete Guide

Navigating the world of personal loans can be tricky, especially for non-U.S. citizens. Many financial institutions have specific policies regarding loan eligibility for those who are not U.S. citizens. However, with the right knowledge and approach, securing a personal loan in the U.S. is possible. This comprehensive guide will walk you through everything you need to know, from eligibility and application processes to mitigating risks and improving your chances of approval.

1. Explaining Personal Loans for Non-U.S. Citizens

Personal loans are unsecured loans that individuals use for a variety of purposes, including debt consolidation, medical expenses, home improvements, or funding major life events. Non-U.S. citizens, including those with student visas, work visas, or green card holders, may also apply for these loans, though there are specific requirements and challenges to consider.

Unlike U.S. citizens, who typically have access to a broader range of lenders, non-U.S. citizens may face limitations. Banks and lenders may require a longer history of U.S. credit or a cosigner to approve the loan. In some cases, non-citizens may be eligible for loans even without a U.S. credit history, but they must meet other criteria such as income verification, proof of residency, and legal status in the country.

Personal loans for non-U.S. citizens come in various forms, including fixed-rate loans, variable-rate loans, and installment loans. Each has its benefits and risks, and choosing the right one depends on your financial situation and goals.

2. Step-by-Step Process for Applying for Loans

Applying for a personal loan as a non-U.S. citizen involves several steps. Here’s a clear breakdown of the process:

Step 1: Research Lenders

The first step is to identify lenders who offer loans to non-U.S. citizens. Not all banks or financial institutions provide loans to individuals without a U.S. citizenship, so it’s essential to find those that do. Many online lenders, credit unions, and community banks are more flexible and may be willing to work with non-citizens.

Step 2: Review Your Financial Situation

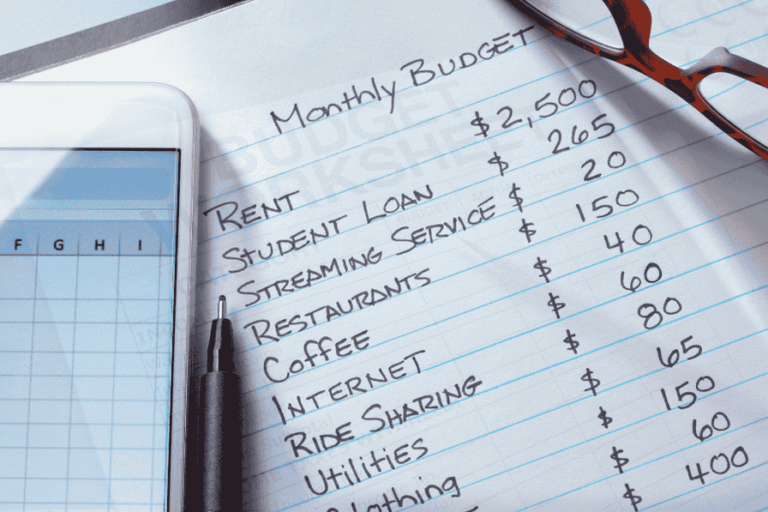

Before applying for a loan, assess your financial situation. Determine how much you need to borrow, and review your monthly income, credit score, and any existing debts. Lenders will consider these factors when reviewing your application.

Step 3: Gather Required Documentation

Non-U.S. citizens will need to submit additional documentation to demonstrate their eligibility. This may include:

- Valid visa or green card

- Proof of income (pay stubs, bank statements, tax returns)

- U.S. address (utility bills, lease agreements)

- Proof of employment or self-employment

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

Step 4: Check Your Credit Score

If you have a U.S. credit history, check your credit score before applying. This will help you understand your chances of getting approved and allow you to take steps to improve your score if necessary. If you don’t have a U.S. credit history, some lenders may accept alternative forms of credit, such as international credit reports or references from previous lenders.

Step 5: Apply for the Loan

Once you’ve found the right lender and gathered all the necessary documentation, you can submit your application. Many lenders allow online applications, making the process more convenient.

Step 6: Wait for Approval and Loan Offer

The lender will review your application, financial documents, and creditworthiness. If approved, they will send you a loan offer outlining the terms, including the loan amount, interest rate, repayment period, and any fees.

Step 7: Accept the Loan and Receive Funds

If the terms are acceptable, you can accept the loan offer. Afterward, the funds will be disbursed, either as a lump sum or in installments, depending on the loan type and lender’s policy.

3. Loan Eligibility and Requirements for Non-U.S. Citizens

The eligibility requirements for non-U.S. citizens applying for personal loans vary by lender, but most will require you to meet the following conditions:

- Legal Status: You must be legally residing in the U.S. on a valid visa, green card, or permanent residency status.

- U.S. Credit History: While some lenders may consider international credit reports, a U.S. credit history is typically preferred. You will need a credit score to improve your chances of loan approval.

- Proof of Income: Lenders want to ensure you can repay the loan, so they’ll require proof of employment or a steady income source. This could be in the form of pay stubs, tax returns, or bank statements.

- Social Security Number (SSN) or ITIN: Many lenders will ask for a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to verify your identity and track your credit history.

- Residency Proof: You may need to provide proof of residence, such as utility bills or a lease agreement.

- Age Requirement: You must be at least 18 years old to apply for a personal loan in the U.S.

4. Choosing the Right Lender and Loan Type

Not all lenders are the same, and choosing the right one can have a significant impact on your loan experience. Here are some factors to consider when selecting a lender:

Online Lenders

Online lenders often provide more flexible loan options for non-U.S. citizens, especially if you don’t have a U.S. credit history. Many online platforms offer fast approvals and competitive interest rates.

Credit Unions

Credit unions are member-focused financial institutions that may offer more favorable loan terms than banks. Many credit unions are more willing to work with non-citizens, particularly if you have a stable financial history or a co-signer.

Traditional Banks

Some large banks may offer personal loans to non-U.S. citizens, but their eligibility criteria can be stricter. They may require a strong U.S. credit history, proof of citizenship or permanent residency, and a U.S.-based co-signer.

Loan Types

When choosing a loan, consider the different types available:

- Fixed-rate Loans: Your monthly payments remain consistent throughout the life of the loan, which can help with budgeting.

- Variable-rate Loans: These loans have interest rates that can change over time, potentially lowering your payments but also introducing uncertainty.

- Secured Loans: Secured loans require collateral, such as a car or property, in exchange for the loan. They may offer lower interest rates but put your assets at risk if you fail to repay.

5. Potential Risks and How to Mitigate Them

Taking out a loan always carries some level of risk, and non-U.S. citizens may face additional challenges. Here are some potential risks and tips on how to mitigate them:

Risk 1: Higher Interest Rates

Non-U.S. citizens may face higher interest rates due to a lack of U.S. credit history or limited lending options. To mitigate this, try to apply for loans from lenders who specialize in working with non-citizens, and consider opting for a secured loan to lower the interest rate.

Risk 2: Loan Denial

If you don’t meet the lender’s criteria, you may be denied the loan. To reduce this risk, ensure you meet all eligibility requirements, provide all necessary documentation, and have a co-signer if possible.

Risk 3: Loan Scams

Some predatory lenders target non-U.S. citizens, offering loans with hidden fees and unfavorable terms. To avoid falling victim to loan scams, always research lenders thoroughly, read the loan agreement carefully, and avoid lenders who pressure you into signing quickly.

Risk 4: Currency Fluctuations (For Non-Resident Borrowers)

If you’re a non-U.S. citizen borrowing from outside the U.S., currency fluctuations could impact the cost of your loan. It’s essential to consider exchange rates and how they may affect your ability to repay the loan.

6. Improving Chances of Loan Approval

While non-U.S. citizens face additional hurdles in securing personal loans, there are several ways to improve your chances of approval:

- Build a U.S. Credit History: If possible, establish a U.S. credit history by using credit cards, paying bills on time, and ensuring your credit score is in good standing.

- Provide a Co-Signer: Having a U.S. citizen or permanent resident as a co-signer can increase your chances of loan approval, especially if you lack a U.S. credit history.

- Show Stable Income: Lenders prefer applicants with a stable income. Be prepared to show proof of your income and employment history.

- Choose the Right Loan Amount: Apply for a loan amount you can comfortably repay. Borrowing more than you can afford can negatively impact your approval chances.

Conclusion

Securing a personal loan as a non-U.S. citizen is possible, but it requires careful planning and understanding of the eligibility requirements. By following the step-by-step process outlined above, choosing the right lender and loan type, and taking measures to mitigate risks, you can improve your chances of successfully obtaining a personal loan. Always be mindful of the potential risks and take steps to protect yourself from predatory lenders. With the right approach, a personal loan can help you achieve your financial goals, whether you’re looking to consolidate debt, make a major purchase, or cover unexpected expenses.